Why is Batam good for your business?

The Special Economic Zone (SEZ) of Batam is the first one opened in Indonesia and includes not only the island of Batam, but also Galang Baru, Rempang Galang, Nipah, Tonton and Setokok islands, all positioned in one of the most active shipping routes, between Singapore and Sumatra.

Batam SEZ has been established in 2007 and the Investment Law (art. 31/1) makes it a Special Economic Zone for 70 years. Article 2/1 prioritizes the following economic fields: trade, maritime, industry, transportation, banking and tourism.

It is easy to understand why Batam can be a perfect area to establish a business for foreigners and not only for locals. But we are going to take a deeper view of the advantages of establishing a business in Batam, advantages that are not limited to customs and tax exemptions.

- Better infrastructure.

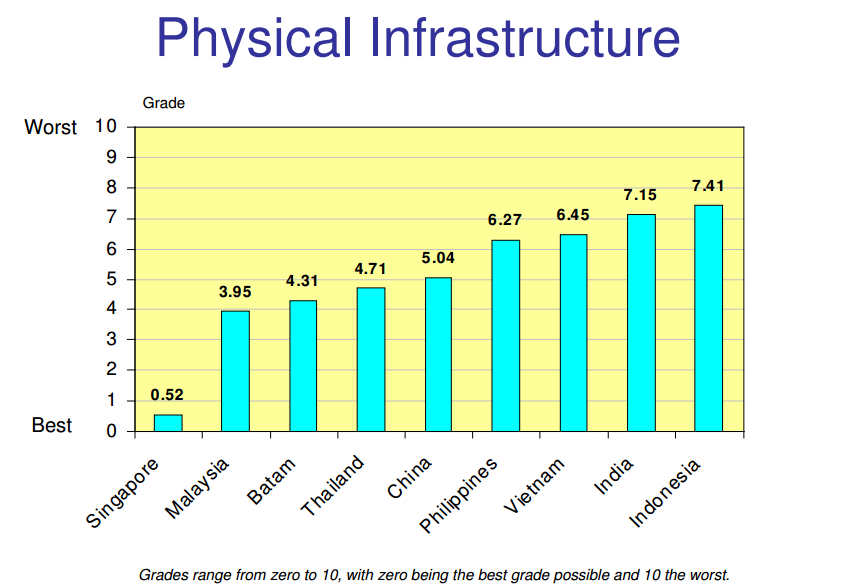

Batam has better physical infrastructures than the rest of Indonesia

According to a study from Political and Economic Risk Consultancy, the reasons why Batam infrastructure is better are mainly the following:• Foreign supplies are easier to move through Batam port and airport compared to Jakarta and to the rest of Indonesia.

• Exporting finished products from Batam port and airport is easier compared to the rest of Indonesia (including Jakarta).

• The main infrastructure, as for example water supply and energy supply, are at the same level as the ones in Jakarta, considerably higher than in other parts of Indonesia. In other parts, in fact, investors/business owners have to build such infrastructure themselves.

• Being so close to Singapore. If any facility is missing in Batam, it can be found in Singapore (for example world-class hospitals). - Fast lane for foreign investments

In less than 20 working days, foreign investment applications are processed. All the licenses and permits are processed by one single entity, BIDA (Batam Industrial Development Authority), making everything easier. - It is close to Singapore

Batam is one ferry ride away from Singapore (around 13 miles – 20 km). Singaporean manufacturing firms are already taking advantage of the local taxation and the cheaper labor costs.

Batam exports 50% of local production to Singapore, and over 70% of the investments are coming from Singapore. - Labor

Wages in Batam continue being lower than the ones in nearby Singapore and Malaysia. Data from 2013 show about 210USD per month.

Labor is widely available, new workers are coming to Batam from other parts of Indonesia. - Taxation

Batam is a free port and a free trade zone, which offers interesting incentives to companies producing in Batam for export. - VAT & LST – Value Added Tax and Local Service Tax

In accordance with local rules, the great majority of transactions to enter services or goods in Batam are VAT and LST exempted (always remember to verify if your products are part of this of this majority!). - Import taxes

When goods are imported into Batam or exchanged among companies within the free trade zone, no import duty is applied. But if those same good enter other parts of Indonesia, then all the import duties and taxes are applied.

These are the main reasons why Batam can be the perfect spot for foreign companies to start doing business with SE Asia. Singaporean companies are currently the ones taking more advantage of these unique features of Batam, but there are opportunities for companies from all over the world.